The Bloomberg ETFs in Depth conference last week in New York conveyed a clear message: ETFs cannot grow and prosper without effective marketing. The ETF landscape is littered with great funds that never thrived because investors didn’t know what purpose they served or perhaps didn’t even know they existed. While there’s still plenty of room for the ETF sector to expand, it’s certainly much easier to launch a fund than it is to sustain and grow one.

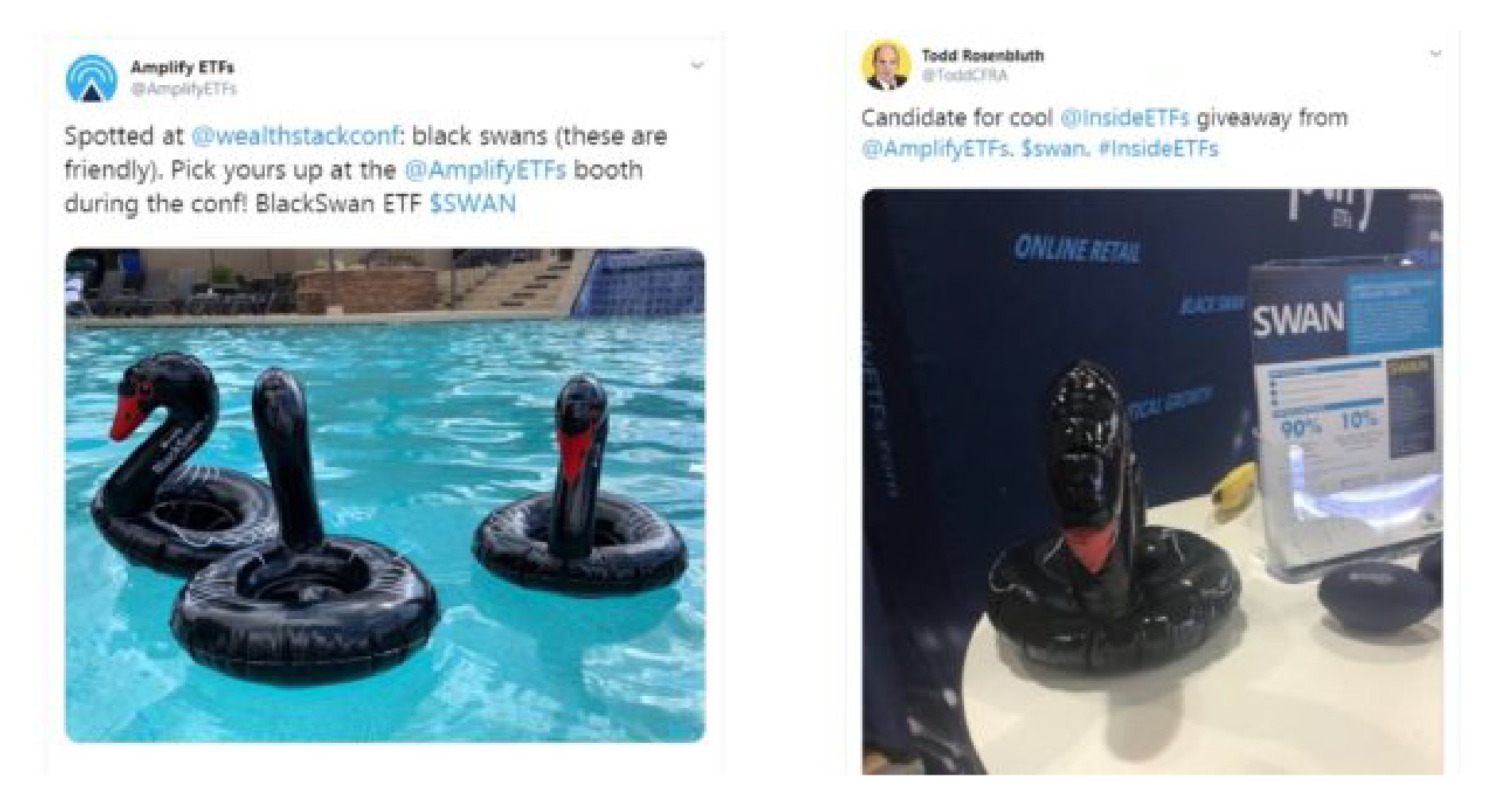

Issuers must look beyond traditional platforms to capture the attention of buyers. More and more ETFs rely on social media outreach and clever campaigns to generate the name recognition they need. For example, Gregory FCA client Amplify ETFs has traveled to conferences and bell ringings with inflatable black swans to promote the Amplify BlackSwan Growth & Treasury Core ETF. Unusual and eye-catching tactics like this can create a buzzworthy effect at an event and inspire other attendees to share your campaign on their own social channels.

Although social media isn’t necessarily a “new” way to share an ETF’s messaging, some issuers still avoid it out of an abundance of caution because they’re concerned about potentially violating compliance guidelines or SEC standards. While an issuer might save themselves some compliance headaches by sticking to old-school marketing channels, they also risk the future success of their ETF by forgoing strategies that could vastly expand their network of potential investors.

Social media success stories

Fortunately, some of the industry’s most adept social media marketers are willing to share what has worked for them. Josh Brown, CEO of Ritholtz Wealth Management, and Cathie Wood, founder, CEO and CIO of ARK Invest, talked at ETFs In Depth about how they’ve magnified visibility and investor interest through social media without running afoul of compliance.

Brown urged attendees to take their business seriously … but not take themselves too seriously. Social media can offer an opportunity for an issuer to get creative, share their investing philosophy with the public, build name recognition and expand their contacts. Social media users typically don’t respond to content created just to chase clicks, but useful, actionable content helps generate interest and build the foundation of a solid marketing campaign, said Brown.

Sharing your content on social media can even lead to firm improvements, Wood related. If you have information that contradicts the general market, she suggested that promoting your findings could be a good course of action. “Our research is better due to social media,” said Wood. “If we share something and get pushback, it allows us to see what we might have gotten wrong.”

She also explained why ARK analysts and asset managers are encouraged to use their social platforms to obtain feedback on investment ideas. While many firms play it safe and keep their analysts away from social media, Wood suggested these channels actually help issuers offer transparency to investors. If your firm decides to enter the social media realm, Brown advised issuers and advisors to take the same approach they would with TV appearances and print materials in order to meet compliance and SEC standards.

Embracing nontraditional outreach

Social media can give forward-looking issuers a competitive advantage over companies that avoid these platforms, as the financial world starts to embrace nontraditional outreach and brave “parts unknown” to reach an untapped, younger market segment. Regarding his Twitter fame, Brown commented that he got lucky in earning more than a million followers, benefiting from being on the platform at the right time as he “figured this thing out before everyone else.”

His influence highlights the importance of being a pioneer. Going outside your comfort zone and making your own luck are key concepts for financial services marketers who want to build a major following. Brown told the audience that his influencer status proved vital in growing his previously midsized RIA into a billion-dollar firm. How much of that growth does he attribute to his fan base on Twitter? “100%,” said Brown.

Innovative approaches

Direct-to-consumer marketing offers opportunities for ETF marketers to stand out from the crowd even beyond social media. For instance, State Street Global Advisors has teamed up with “Pitch Perfect” actress Elizabeth Banks to help raise awareness about its mid-cap assets via a video series that incorporates comedic elements. Matthew Bartolini, managing director for the company, said in a recent CNN Business article that working with Banks allowed State Street to do something more distinctive than other investing ads. “Trying to get across a message for mid-cap investing can be dry,” he added.

Gregory FCA also employs an innovative approach, exemplified by a podcast series called “Unfiltered: Duran + Kitces” that features Joe Duran of client United Capital and Michael Kitces, a prominent financial services influencer. This type of partnership model relies on genuine engagement with influential players in the industry and can achieve eye-opening results.

The marketing world is changing and so should your strategy. It’s more important than ever to expand your presence on social media and alternative multimedia platforms. The sooner you explore new mediums, the better chance you’ll have to foster relationships with new market segments.