Welcome to the latest edition of The ETF Marketing Memo! The ETF landscape is more crowded than ever, and capturing attention requires more than a good idea—it takes smart strategy, timely storytelling, and a multi-channel approach. In this issue, we break down how ETF launches have evolved from simple rollouts to complex, content-driven campaigns, share key insights from Bloomberg Intelligence’s David Cohne on dual share classes and active ETF trends, and highlight the successful debut of LionShares’ TOT ETF and its media impact.

As always, we’re here to help you stay ahead of the curve and keep your ETF top of mind—subscribe here!

Launching ETFs Then vs. Now: A Marketing Perspective from the Trenches

By Kerry Davis, Senior Vice President

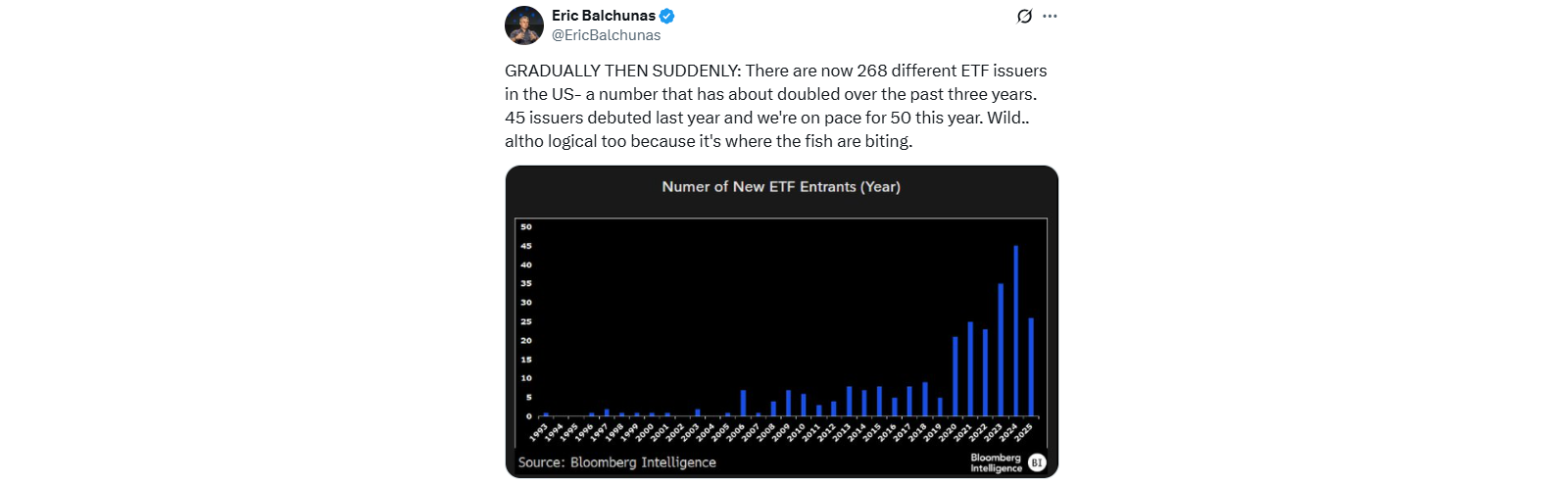

268. According to Bloomberg Intelligence, that’s the number of ETF issuers in the market as of July 2025. A decade ago, I supported the launch of a first-mover ETF capturing a timely growth trend from a startup issuer. Today, I’m proud to report that the same sponsor continues to make headlines with a full lineup of strategies—but the marketing landscape they navigate has fundamentally transformed.

Having worked alongside ETF clients through both eras, I’ve witnessed firsthand how launching and promoting ETFs has evolved from a relatively open field to an intensely competitive arena requiring sophisticated, multi-channel strategies.

Social Media: From Corporate Taboo to Marketing Essential

Then: Social media was virtually taboo among asset managers. Most viewed it as inappropriate for financial products, focusing instead on traditional trade publications and direct advisor outreach.

Now: Fresh, consistent social content is essential for keeping strategies top-of-mind. The firms winning mindshare today treat social platforms as critical distribution channels.

This shift has significantly expanded our content creation. Where we once focused solely on press releases and media pitches, we now develop integrated content strategies, including LinkedIn and X, as well as for video platforms like YouTube.

The Influencer Economy: New Voices, New Audiences

Then: Industry influence was concentrated among a handful of traditional financial media outlets and established analysts.

Now: Micro and macro influencers across podcasts, YouTube, and social platforms command audiences that rival traditional media. Smart issuers are building relationships with these voices, but the key is strategic vetting to ensure audience alignment.

We’ve developed frameworks for evaluating influencer partnerships, analyzing audience demographics, engagement quality, and content alignment with our clients’ brand values and target markets.

GEO: The New SEO Reality

Then: Search engine optimization focused on website rankings and traditional keyword strategies.

Now: Generative Engine Optimization (GEO) has changed the game. AI-driven search results occupy prime real estate at the top of search pages, fundamentally altering how potential investors discover ETF information.

We analyze which sources feed these AI results and adjust our outreach strategy accordingly. We’re working to earn coverage in the right places that algorithms respect and cite.

Earned Media’s Renaissance

Then: Media coverage was valuable but often isolated from other marketing efforts.

Now: In the GEO era, quality media placements have received a relevance boost. Placements in third-party sources are feeding human readers and the AI systems that increasingly shape investor research. This is a welcomed validation for those of us championing PR’s strategic value.

The Intelligence Imperative

Then: Following a few key trade publications kept you reasonably informed about competitive developments.

Now: The media landscape has exploded. From changes at ETF.com to newcomers like ETF Upside, staying current requires dedicated resources and deep market knowledge. Understanding which stories to pursue, which angles resonate, and where to place them demands full-time attention to the space.

Clients need partners who live and breathe this market instead of generalist agencies learning the space on their dime.

Beyond Novelty: The Data-Driven Conversation

Then: A unique strategy and solid fundamentals could carry a launch for months.

Now: Novelty alone doesn’t sustain momentum. Flows, trading volume spikes, and performance drive daily conversations. Whether spot bitcoin ETFs create category excitement or sector rotation drives thematic interest, data storytelling has become crucial for maintaining relevance.

We’ve built capabilities around real-time data monitoring and honed our rapid response approach, ensuring our clients can capitalize on market moments as they unfold.

What Hasn’t Changed (And What Has)

The fundamental principles for launching an ETF remain constant: know your audience, launch impactfully, and follow through consistently with relevant updates that keep your strategy compelling.

But execution looks radically different. Where we once focused on a handful of trade publications and direct advisor relationships, today’s successful launches require orchestrated campaigns across traditional media, social platforms, influencer partnerships, and GEO-optimized content, all while maintaining the authentic, data-driven storytelling that builds lasting credibility.

The Bottom Line

The ETF marketing landscape has evolved from a relatively straightforward environment to a complex, multi-channel ecosystem requiring specialized expertise and constant adaptation. Success today demands partners who understand where the industry has been, where it’s heading, and how to position clients ahead of the curve.

Q&A with David Cohne, Mutual Fund & Active Management Analyst at Bloomberg Intelligence

By Caitlyn Kardish, Senior Vice President

I had the chance to catch up with Bloomberg Intelligence’s David Cohne earlier this month at the first-ever ICI ETF Conference in Nashville. David leads Bloomberg’s research on the mutual fund industry and active managers — and if you haven’t checked it out, he also hosts the Inside Active podcast, where he chats with top active managers and digs into new opportunities for investors.

Read on for his biggest takeaways from the conference, what he’s keeping an eye on in the active space, and more.

Dual share class took center stage at the ICI ETF conference. What was your biggest takeaway from panel discussions and other conversations on the topic?

Based on panels I attended and discussions I had, SEC approval of the ETF share class is imminent, and the focus should now be on the nuts-and-bolts needed to launch them, including infrastructure, recordkeeping, and compliance. There also seemed to be a desire for a universal system for exchanges and record keeping.

Mutual fund-to-ETF conversions continue to be front of mind. From your perspective, what are the most important considerations for managers weighing a conversion today?

I think managers need to view a conversion holistically. Determine if a conversion will enhance their long-term value proposition for both current shareholders and future ETF investors. While track record continuity is great, some strategies which invest in illiquid investments or in small markets that need capacity constraints aren’t necessarily a great fit for ETFs.

Active ETFs dominated the agenda. Based on what you heard, how are investor expectations shifting when it comes to transparency, liquidity, and performance in the active ETF space?

Active ETF investors today expect more access than they would with an active mutual fund. They want clear transparency in the form of daily holdings, which can provide more timely insights into manager portfolio positioning. They also want tight spreads. With mutual funds, they expected ease of redemption, but not intraday access. With ETFs, they want instant tradability and tight execution. When it comes to returns, they expect lower fees in the ETF wrapper but may be willing to pay slightly higher fees for active if a fund’s performance can justify those fees.

Your Inside Active podcast takes listeners deep into the world of active management. What gap are you trying to fill in the industry conversation with the show?

There’s no shortage of investing podcasts out there, but what we saw missing was a show that really shines a light on the world of active management itself, not just markets or macro headlines. Too often, the narrative is that passive has won and active is dead. We know that’s not the full story. Active managers are still innovating and adapting. With Inside Active, we wanted to go deeper into the philosophy and process behind active investing: how managers think about building portfolios, where they try to generate edge, and how they manage risk.

Which recent Inside Active episode best captures the state of active ETFs today, and what themes or guests are you most excited to feature in the coming months?

I’d point to our episode with Janet Rilling, Head of the Plus Fixed Income team at Allspring Global Investments. She gives a great look at how active bond ETFs are being managed today, which is useful for understanding what active ETF strategies in fixed income look like in practice.

We’ve got some interesting conversations coming up. One is with a CLO team, where we’ll dig into how collateralized loan obligations are being used and what that says about the broader credit markets. We’re also speaking with a portfolio manager who applies technical analysis in active management, which should give listeners a very different perspective on how charts and signals inform real investment decisions.

Storytelling Success: Introducing A New Voice in ETF Design with the Launch of LionShares’ TOT ETF

By Klaudia Wierzbowska, Account Director

This September, newly founded ETF issuer LionShares approached Gregory FCA to support the launch of its debut fund, the LionShares U.S. Equity Total Return ETF (NYSE: TOT). The goal was to introduce a first-of-its-kind fund while establishing Sofia Massie, the firm’s 25-year-old CEO and founder, as an influential new voice in ETF innovation.

From the outset, the PR team built the campaign around three strong, distinct storylines. For financial and trade press, we focused on TOT as the first U.S. equity total return ETF designed to solve the structural problem of dividend tax drag and deliver a more complete market return. For leadership and entrepreneurship outlets, we positioned Sofia as a young female founder with ETF-native expertise, highlighting how her quantitative background and fresh perspective enable her to rethink product design for the next generation of investors. For personal finance media, we framed TOT as a straightforward, long-term wealth-building solution that allows investors to keep more of their returns compounding, appealing to those who value time in the market over timing it.

The results underscored the power of this focused media strategy. The launch generated 14 pieces of high-impact coverage across influential outlets, including Bloomberg ETF IQ, InvestmentNews, ETF Express, With Intelligence, The Daily Upside, Schwab Network, and Benzinga, collectively reaching an estimated 139 million unique visitors per month. More importantly, the coverage consistently echoed the themes we set from day one to validate TOT’s position as a groundbreaking ETF and establish Sofia as a credible, forward-looking leader in the industry.