Community banks are using AI to outmaneuver financial giants and traders are tapping into blockchain to access strategies once reserved for hedge funds.

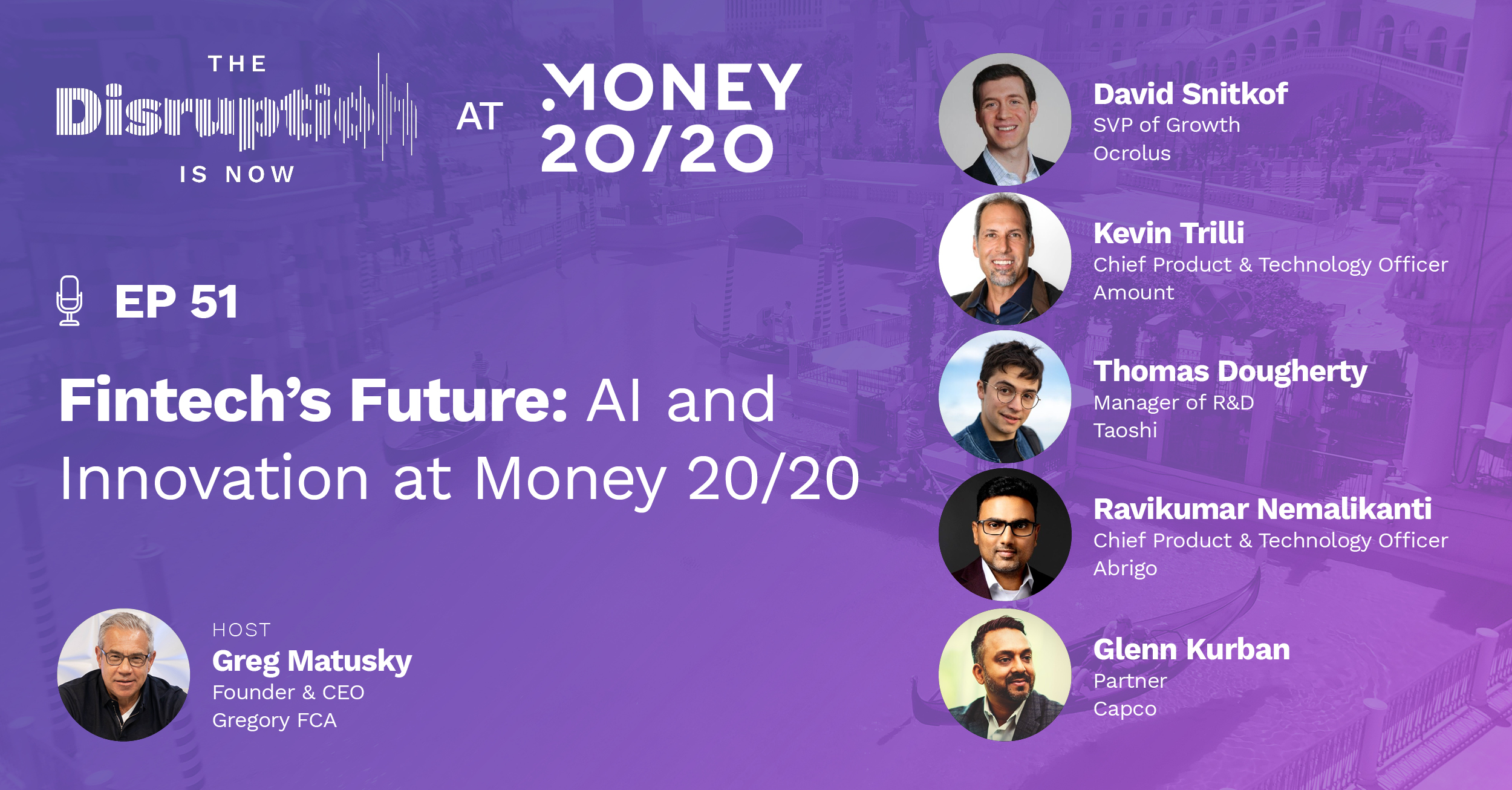

On another episode of The Disruption is Now from the floor of Money2020, host Greg Matusky speaks with:

- Glenn Kurban, Partner at Capco

- Ravi Nemalikanti, Chief Product and Technology Officer at Abrigo

- Thomas Dougherty, Manager of Research and Development at Glitch

- Kevin Trilli, Chief Product and Technology Officer at Amount

- David Snitkof, SVP of Growth at Ocrolus

They reveal how fintech companies are doing everything from making compliance transparent to democratizing elite trading tools.

Watch now:

Key takeaways

Data governance and human oversight lead to AI success

Glenn notes that although financial services has traditionally been a conservative industry, it’s now eagerly adopting AI in back-office functions to reduce costs and boost efficiency, driven by board-level directives.

He emphasizes that successful AI implementation hinges on robust data governance and high-quality data. Despite the compliance challenges posed by AI’s “black box” nature, he suggests firms accept some risk but enforce stringent validation processes. Crucially, he advocates keeping humans in the loop to oversee AI outputs, ensuring accuracy and compliance.

Community banks use AI to level the playing field against big banks

Ravi points out that giants like Chase employ over 900 data scientists, a luxury smaller banks can’t afford.

Abrigo’s AI-driven software helps these institutions offer services like automated loan origination for commercial, agricultural, and construction loans, as well as SMB lending. On the back end, Abrigo provides tools for compliance in areas like anti-money laundering, asset liability management, and fraud detection.

This allows community banks to compete with larger banks by improving efficiency and offering modern financial products.

AI and blockchain combine to democratize elite trading strategies

Thomas describes how Glitch is merging AI with blockchain to democratize access to sophisticated trading strategies.

Traditionally, hedge funds with significant capital have exclusive access to high-quality algorithmic trading. Glitch allows users worldwide to contribute and simulate trading strategies on its blockchain platform. By aggregating the top-performing strategies using AI, it offers everyday investors the ability to deploy automated trading bots that rival professional tools.

This non-custodial approach lets individuals maintain control over their funds while accessing advanced trading capabilities, effectively leveling the investment playing field.

Mid-sized banks optimize lending with AI-powered tools

Amount provides mid-sized banks and credit unions with AI-streamlined loan processing and risk management. Kevin explains that the platform automates underwriting, enhances user experiences, and helps banks expand into new product areas like consumer credit cards and personal loans.

By using AI to analyze data and optimize configurations, banks can target specific credit segments, adjust risk profiles, and improve profitability. The platform employs machine learning to continuously refine lending strategies based on aggregated, anonymized data from their client base, ensuring privacy while leveraging collective insights.

AI dramatically reduces underwriting times while improving accuracy and quality

David describes how AI can speed up mortgage underwriting from the 41 days it might take to complete manually. Underwriting a mortgage is an old bottleneck that AI makes more efficient. And because the models doing the work have a massive training set, including documents from coutnlesss banks and in countless formats, AI tools can better ensure accurate outcomes and better fraud detection.

For example, Ocrolus spots subtle edits deep within documents, perhaps a change to an account number or balance, which is a sign there might be fraud.

Key moments

- What AI means for financial services (1:48)

- How AI will help with back-office tasks (5:33)

- Where to find AI cost savings in an enterprise (6:52)

- Abrigo’s role in empowering community banks with AI solutions (11:45)

- How small banks can compete with industry giants using technology (13:42)

- The significance of explainable AI in compliance and fraud detection (14:55)

- Challenges of deploying AI in enterprises (17:35)

- Glitch’s approach to automated trading with AI and blockchain (19:38)

- Using blockchain to aggregate and optimize trading strategies (21:30)

- Amount’s AI-powered tools for loan processing and risk management (24:13)

- The future impact of AI on business-to-business software (27:06)

- The ongoing arms race in fraud and risk management (29:05)

- How Ocrolus speeds up mortgage underwriting (30:14)

- Spotting signs of fraud in documents (35:35)

- AI for cash flow analytics (36:47)

- Solving non deterministic problems in lending (39:09)